tax benefit rules for trusts

111 partially codifies the tax benefit rule which generally requires a taxpayer to include. Since trusts enter the highest tax bracket 37 once they exceed 13051 of taxable income in 2021 individuals do not reach this bracket until their taxable income exceeds 628301 for married filing jointlymany trusts will see a significant tax benefit from making these distributions.

Exploring The Estate Tax Part 2 Journal Of Accountancy

Tax rates can be high on income kept within a trust so it may be tax efficient to distribute most of the income but keep the principal within the trust.

. That may be the case because the trust will take a deduction for the distribution and given the higher thresholds for individual filers depending on the beneficiarys overall income level the beneficiary may be in a lower tax. 642 c these rules are substantially different from the rules for charitable contribution deductions for individuals and corporations under Sec. It is not a juristic legal person but there are times when in terms of certain statutes a trust is regarded as having a separate legal identity for example for tax purposes in terms of the Income Tax Act.

Select Popular Legal Forms Packages of Any Category. From Fisher Investments 40 years managing money and helping thousands of families. The tax on these two parts is then calculated separately to arrive at the total tax payable on the trusts income.

Another Tax Cut and Jobs Act benefit and this is the No. Contributions to a 2503 trust can constitute a present interest even if the beneficiary does not have the right to withdraw if under the trust. Interest in Possession Trusts Income arising in Interest in Possession Trusts is taxed at the basic rate of tax ie.

Trust income tax brackets are notoriously steep with a tax rate for 2010 of 35 starting when income reaches only 11200. Assets in trust avoid the cost time expense and publicity of probate. What happened with the Tax Cuts and Jobs Act is we now have this new 10000.

75 on dividend income and 20 on all other income. Charitable income tax deductions for trusts and estates. The disabled individual under age 65 can benefit from the assets or income transferred in any way either at the time of the transfer or at any time in the future and 2 the spending of the funds involved for the benefit of the individual is actuarially sound based on the life expectancy of the.

Income tax charitable deductions for trusts and estates are governed by Sec. While in legal terms a trust is a relationship not a legal entity trusts are treated as taxpayer entities for the purposes of tax administration. Beneficiary income and trustee income.

A trust treated as a separate taxpayer from the grantor for income tax purposes Guiding principle of the grantor trust rules. Revocable trusts also called living trusts are one of the more frequently misunderstood trust concepts. Ad Take out the guesswork with The Investors Guide to Estate Planning for 500k portfolios.

Ad Instant Download and Complete your Certificate of Trust Forms Start Now. Find out more by reading the information on different. In year 2 your income is increased such that you eventually get taxed and the gimmick fails.

Section 2503 presents a narrow exception to that requirement of a present interest rule which has significant tax benefits. The trusts income is separated into two parts for tax purposes. If the Beneficiary only pays tax at the basic rate they can claim a refund of any excess tax on their Self- Assessment tax return for the year.

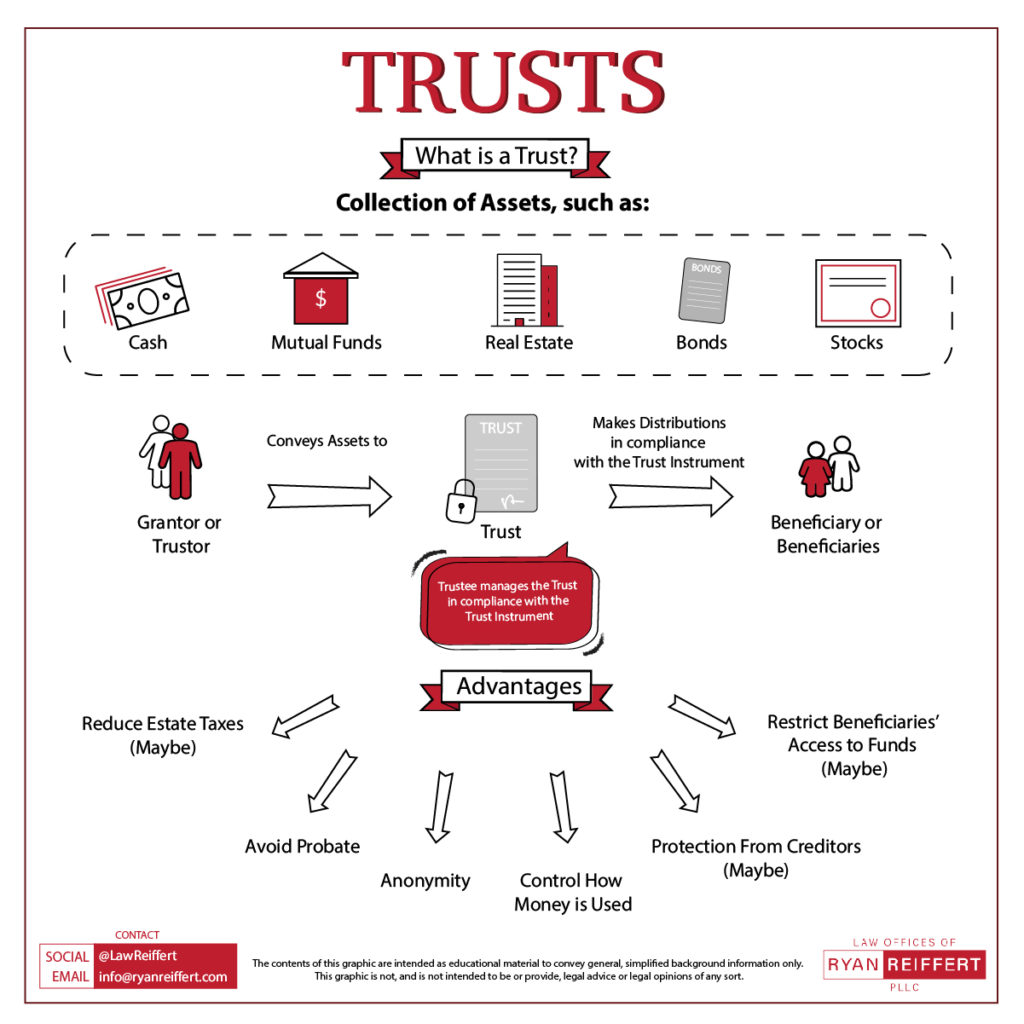

When preparing wills and trusts it is essential to have good professional advice. The good news is that the trust gets to deduct what it pays out to the beneficiary. A trust is a legal entity which is created to hold assets for the benefit of certain persons or entities.

326 as clarified and modified by Revenue Ruling 2004-67 2004-2 CB. The property and income in the trust may be expended by or for the. The trustee is responsible for managing the trusts tax affairs including registering the trust in the tax system lodging trust tax returns.

State income tax refund fully includable. Generally that amount is calculated in accordance with the trust deed. If a trusts beneficiary is in a lower tax bracket and receives distributions from the trust such a distribution could result in a lower overall tax.

The amount to include at the label headed income of the trust estate is the total income of the trust that is available for distribution to trust beneficiaries for the income year distributable income. 4 benefit for doing non-grantor trusts has to do with the state and local tax the SALT limitation. Basically the rule are set such that you cant game the system by taking a big deduction on state taxes overpaid in year 1 and then get the money refunded to you in year 2.

Sometimes the settlor can also benefit from the assets in a trust - this is called a settlor-interested trust and has special tax rules. IRS Expands Rules for Tax-Exempt Group Trusts. A trust is an obligation imposed on a person or other entity to hold property for the benefit of beneficiaries.

If structured properly the annual gift tax exclusion can be used and if the beneficiary did not exercise his or her Crummey withdrawal rights the trust assets could be maintained by the trust beyond age 21. Income of a trust over which the grantor has retained substantial dominion or control should be taxed to the grantor Where the grantor has released sufficient control. All Major Categories Covered.

A tax benefit in the prior taxable year from that itemized deduction. In addition the trust must provide that 1 no individual or entity except. Trusts also can be worded to avoid assets going to spouses of family members during a divorce.

They are used primarily as a will substitute. 16 2010 the Internal Revenue Service IRS issued Revenue Ruling 2011-1 which modifies the general rules for group trusts described in Revenue Ruling 81-100 1981-1 CB. Beneficiary income is an amount of income derived by a trustee of the trust and.

Had A paid only the proper amount. In 2019 A received a 1500 refund of state income taxes paid in 2018. Assets in a revocable trust are included in the grantors gross estate for federal estate tax purposes.

The bad news is that the income is reported as paid out to the beneficiary and the beneficiary is issued a K-1 showing taxable. Heres how the income is allocated. This can be useful from a tax perspective as it allows.

State tax refunds are only SOMETIMES taxable on the 1040. In some cases it will be different to the taxable income. The usefulness of a trust is based on the fact that a trustee can hold property on behalf a single beneficiary or a group of beneficiaries for their benefit while maintaining control over the property.

To fully leverage tax rates and minimize taxes trust income to the extent of the 10 bracket 2600 for 2019 could be retained in the trust and the. UNDERSTANDING TRUSTS Trusts are a powerful tool for tax and financial planning. Because a revocable trust may be.

Jk Lasser S New Rules For Estate Retirement And Tax Planning Ebook By Stewart H Welch Iii Rakuten Kobo Free Books Online Books To Read How To Plan

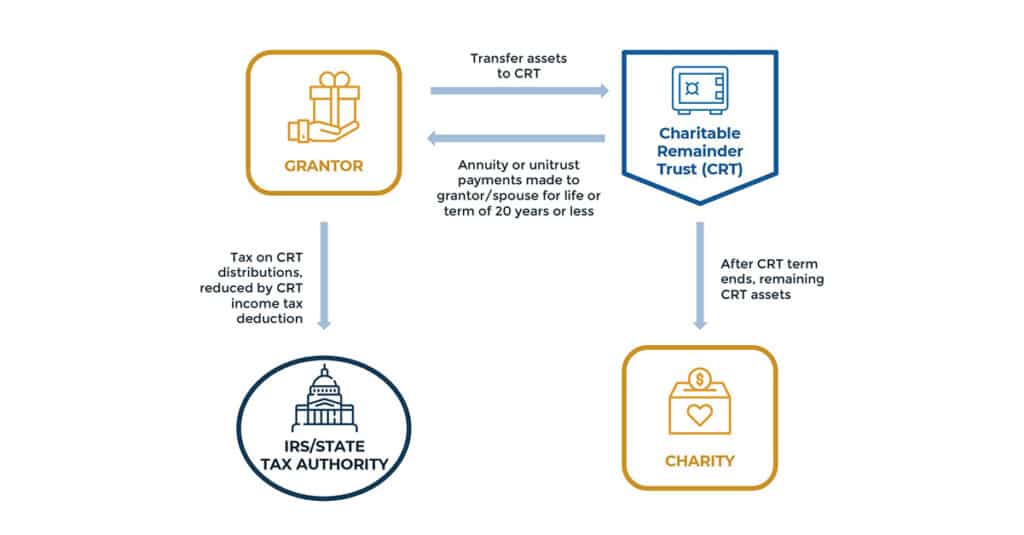

Charitable Remainder Trusts Crts Wealthspire

Distributable Net Income Tax Rules For Bypass Trusts

Distributable Net Income Tax Rules For Bypass Trusts

Why Everyone Needs An Estate Strategy Adams Brown Beran And Ball Financial Services Inc Retirement Advice Investment Advice Strategies

Pin By Debbie Wolfe On Trusts Sell My House Estate Tax Trust

Tax Season Is Here And Real Estate Investors Have To Prepare Use These Tax Saving Strategies Wil Savings Strategy Real Estate Investor Business Tax Deductions

How To Get A Self Employed Mortgage Bookkeeping Business Self Mortgage

Trusts 101 How Many Types Of Trusts Are There Ryan Reiffert Pllc

Trust Registration Service 2020 Trust Tax Rules Online Trust

Will Section 529a Plans Replace Special Needs Trusts Financial Advisory Financial Advisors Social Security Benefits

A Living Trust Is Also Called An Inter Vivos Revocable Trust What You Need To Know John Ross Assets Benefic Revocable Trust Living Trust Estate Planning

:max_bytes(150000):strip_icc()/Form1041screenshot-69d9b8c83e054defaa28caefc685c525.png)

Form 1041 U S Income Tax Return For Estates And Trusts Guide

The Generation Skipping Transfer Tax A Quick Guide

The Shared Equity Model Provides Different Benefits From Traditional Homeownership And Runs Into Different Challeng Home Ownership Being A Landlord University

What Is A Step Up In Basis Cost Basis Of Inherited Assets

Some Trust Distributions Are Subject To Tax Distributions Can Be Structured In Different Ways Revocable Living Trust Estate Planning Attorney Estate Planning

All You Need To Know About Institutional Donors In Your Fundraising Strategy For Your Non Profit Proposalsfor Fundraising Strategies Grant Writing Fundraising